Likewise the office supplies used journal entry is usually made at the period end adjusting entry. Prepare the general journal entry to record this transaction.

Paid Cash For Supplies Double Entry Bookkeeping

Office supplies used journal entry Overview.

. To run successful operations a business needs to purchase raw material and manage its stock optimally throughout its operational cycle. Accounts Payable Supply Company 185000. So Cash Ac would be credited as a reduction in an Asset account is credited.

Also charging supplies to expense allows for the avoidance of the fees. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase. In case of a journal entry for cash purchase Cash account and.

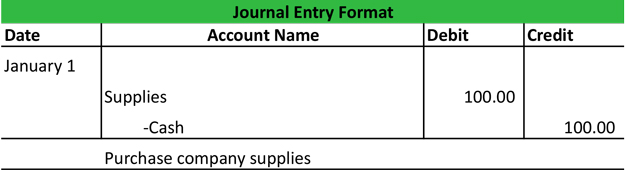

Credit Account Payable e. For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash. Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different accountThis lesson will cover how to create journal entries from business transactions.

Second to record the return of supplies. In accounting the company usually records the office supplies bought in as the asset as they are not being used yet. The accounting records will show the following purchased supplies on account journal entry.

In this case the company ABC can make the journal entry for the paid. This is why you remain in the best website to look the unbelievable ebook to have. Of course the office supplies would be already debited at the date of the purchase with the credit of accounts payable when the company made a credit purchase.

They also record the accounts payable as the purchase is made on the account. For example entries are made to record purchases sales and spoilageobsolescence etc. Paid cash for supplies example.

The journal entry is given below. They need to settle the payable later. Prepare a journal entry to record this transaction.

Thus consuming supplies converts the supplies asset into an expense. Purchase on Account Journal Entry When you make a purchase of supplies on account you must prepare a journal entry that contains one debit and one credit. Q1 The entity purchased new equipment and paid 150000 in cash.

Adjusting Entry at the End of Accounting Period. Sedlor Properties purchased office supplies on account for 800. The company can make the journal entry for the bought supplies on credit by debiting the office supplies account and crediting the accounts payable.

As this journal entry for purchasing supplies on account it ends occurring swine one of the favored ebook journal entry for purchasing supplies on account collections that we have. Journal Entry DebitCredit Equipment 150000 n. The credit entry represents the liability to pay the supplier in the future for the goods supplied.

The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry. When the company purchases equipment the accountant records it into the balance sheet under fixed assets section. The business has received consumable office supplies pens stationery etc and holds these as a current asset as supplies on hand.

Journal entries are the way we capture the activity of our business. The debit is made to the supplies expense account which is a temporary account used to record costs that will be displayed on the income statement. First to record the purchase of supplies on credit.

Journal Entry DebitCredit Equipment 150000 n. Accounting and Journal Entry for Credit Purchase. Only later did the company record them as expenses when they are used.

Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. This entry is made as follows. At the end of the accounting period the cost of the supplies used during the period is computed and an adjusting entry is made to record the supplies expense.

Upon payment of goods purchased in Cash cash balance reduces therefore the asset account is credited according to the Rules of Debit and Credit. Purchasing new equipment can be a major decision for a company. 000 Accounts Payable Cash OC Cash Accounts Payable D.

Various kinds of journal entries are made to record the inventory transactions based on the type of circumstance. Accounts Payable Supply Company 20000. Further two inventory accounting systems record the journal entries for inventories ie periodic and perpetual.

Hence the entry would be. For example on March 18 2021 the company ABC purchases 1000 of office supplies by paying with cash immediately. Accounts Payable Supply Company 165000.

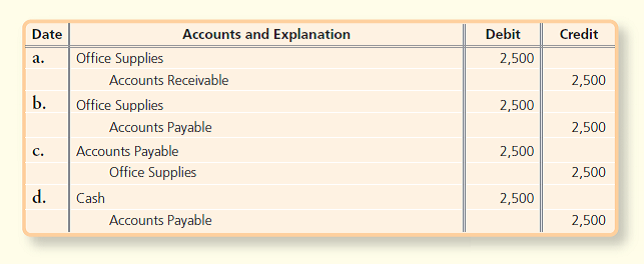

The Green Company purchased office supplies costing 500 on 1. 800 Accounts Payable Accounts Receivable OB. Likewise the office supplies used journal entry is usually made at the period end adjusting entry.

Which Journal entry records the payment on account of those office supplies. Third to record the cash payment on the credit purchase of supplies. Journal Entry for Credit Purchase and Cash Purchase.

Paid Cash for Supplies Journal Entry Example. Assume the purchase occurred in a prior period Date Accounts and Explanation Debit Credit ОА. Purchased Equipment on Account Journal Entry.

Journal entry for purchasing supplies receipt or purchase order forward to completion. In this journal entry the office supplies account is an asset account on the balance sheet in which its normal balance is on the debit side.

3 5 Use Journal Entries To Record Transactions And Post To T Accounts Business Libretexts

Answered Date Accounts And Explanation Debit Bartleby

Buy Equipment With Down Payment In Cash Double Entry Bookkeeping

Purchase Office Supplies On Account Double Entry Bookkeeping

Recording Purchase Of Office Supplies On Account Journal Entry

Undefined Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

Business Events Transaction Journal Entry Format My Accounting Course

0 comments

Post a Comment